Two channels, one platform

Receive complete trade terms directly from dealers in real time, or accelerate trade booking from traditional channels using an AI-powered platform designed specifically for OTC derivatives complexity.

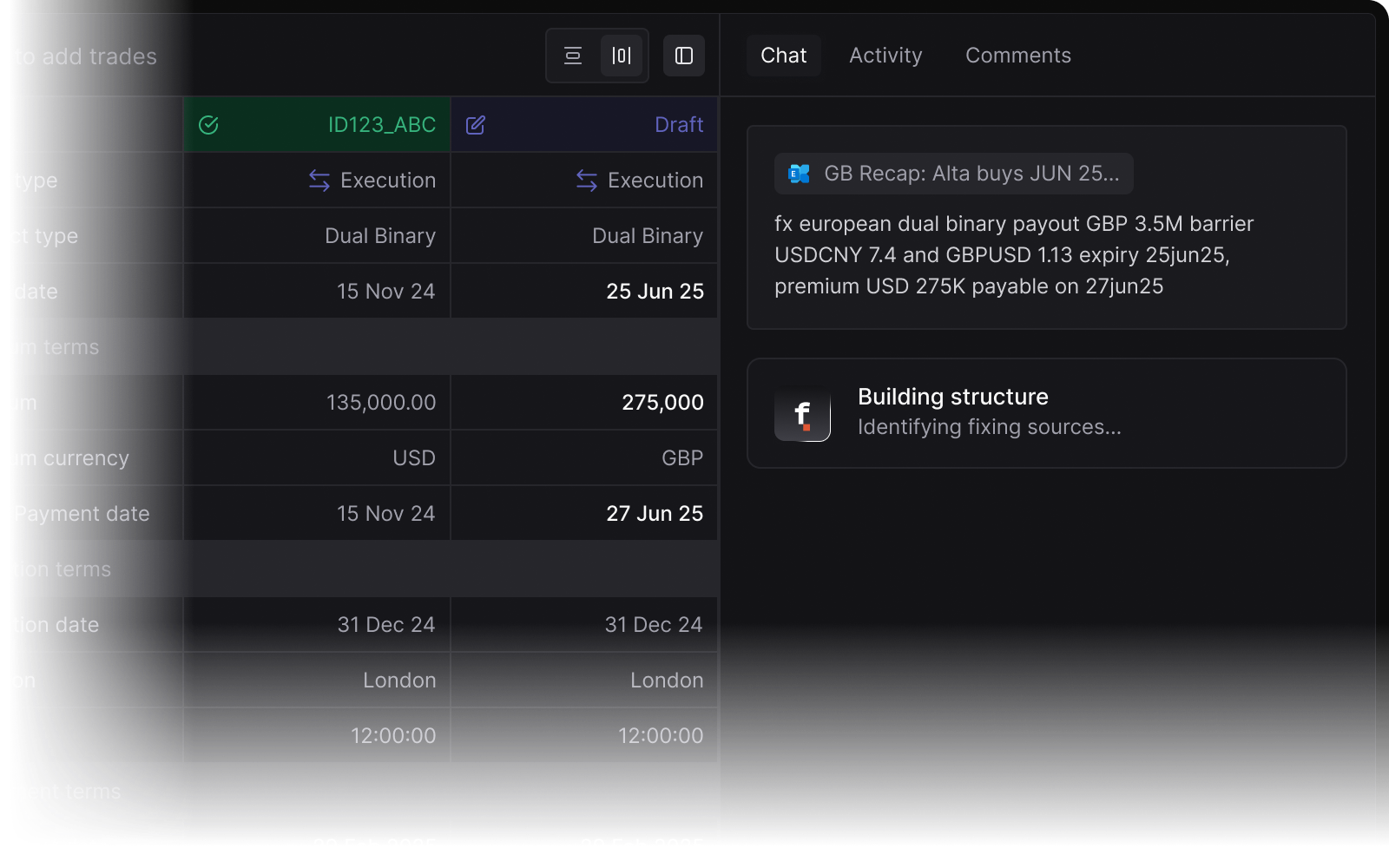

Electronic trade capture

Digital OTC trade recaps delivered instantly from dealers ensures complete alignment with counterparties on T-0.

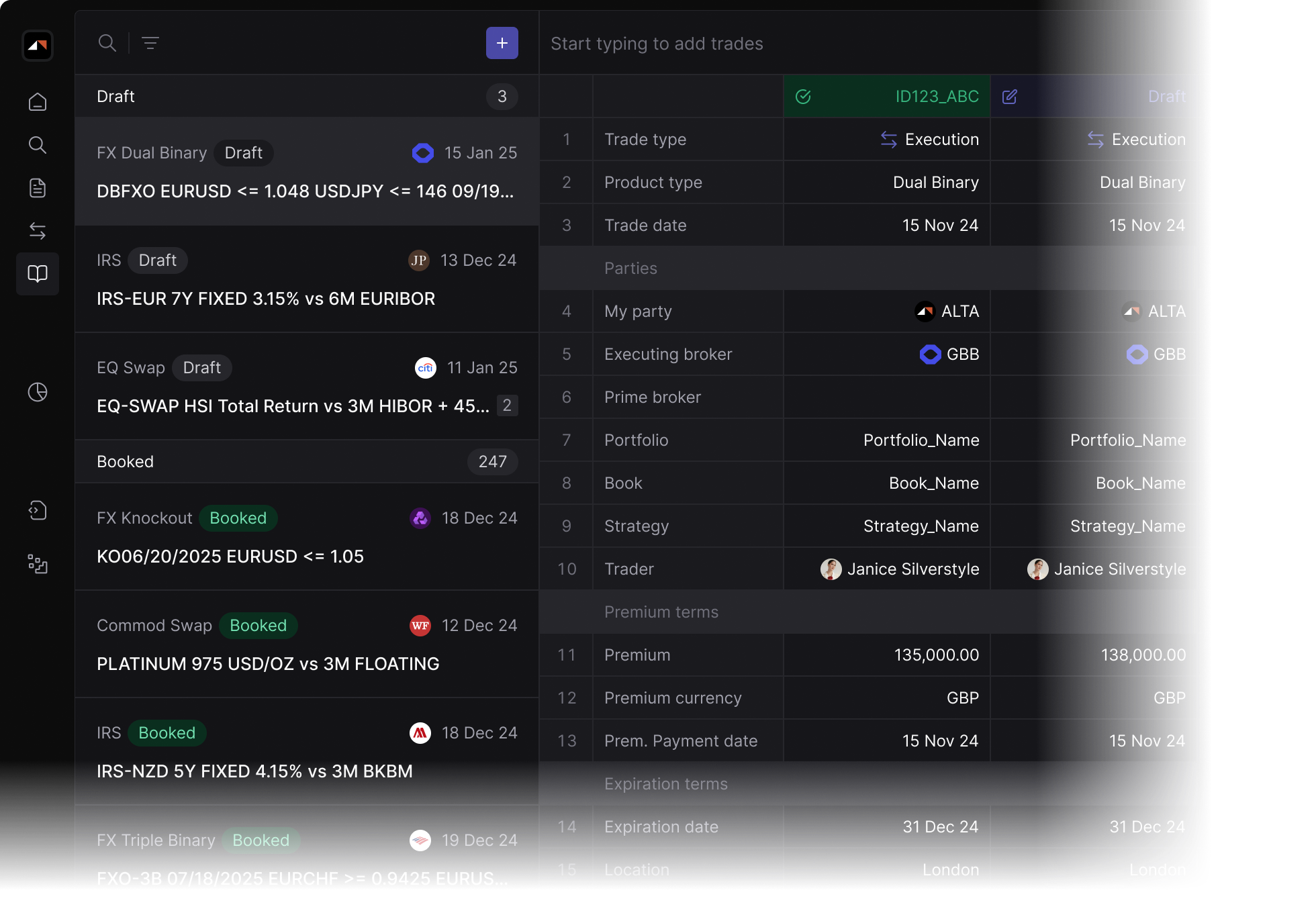

AI-Enhanced trade booking

Book trades across any asset class, from vanilla to the most complex exotic products, with AI powered trade entry.

Complexity, simplified

Built for the complexity of OTC derivatives trading, Float Capture handles both digital connectivity and traditional workflows through one optimized platform. Every feature is designed to reduce errors, accelerate processing, and integrate seamlessly with your current operations.

Digital trade recaps

Gain an immediate view on risk with trade data delivered directly from dealers at point of execution, eliminating the need for both email recaps and manual trade booking.

Guided booking

Reduce transcription time and booking error rates with AI which reads trade recaps and extracts terms from diverse dealer formats

Manage complexity

Book derivatives of any complexity through one optimized workflow which supports any asset class through a single platform.

Learn more

Seamless Integration

Integrate with a single API for programmatic connectivity to manage the full trade lifecycle across every instrument, asset class, and trading counterparty.

Why Float?

Built to integrate seamlessly with your existing infrastructure and dealer relationships. Traditional approaches force you to support disconnected systems with incompatible data models, requiring constant manual synchronization and brittle integrations.

API-First Architecture

Achieve end-to-end automation across the complete trade lifecycle with comprehensive programmatic connectivity.

Continuous Improvement

Platform learns and evolves with your workflows through ongoing feedback loops and adaptive intelligence.

Complete Dealer Flexibility

Trade with any counterparty without compromising your dealer relationships or market access.

Enterprise Security

Enterprise-grade data security and compliance, with full audit trail and fine-grained access controls.

Join the network

Schedule a demo

Join the next generation network for derivatives trading, where complex trades can be managed as seamlessly as flow products, and operational efficiency scales with business growth.